Did you know the Federal Government now makes it mandatory for property owners to report the sale of their Principal Residence?

Over the last year there have been a number of policies introduced from various levels of government in an effort to slow the rapid rise of property markets in centres like Toronto and Vancouver. If you want to keep abreast of the latest market opinions and projections, or simply wish to contribute intelligently at your next dinner party when the the conversation turns to real estate, check out these recent posts; they discuss the foremost policy changes and consequences that may land on the Toronto real estate market this year:

• The Provincial Government Unveils The Ontario Fair Housing Plan

• Will A Vacancy Tax Be Helpful To Toronto Real Estate?

• Dear Urbaneer: Will We Have To Accept Less For Our Home If The Market Shifts?

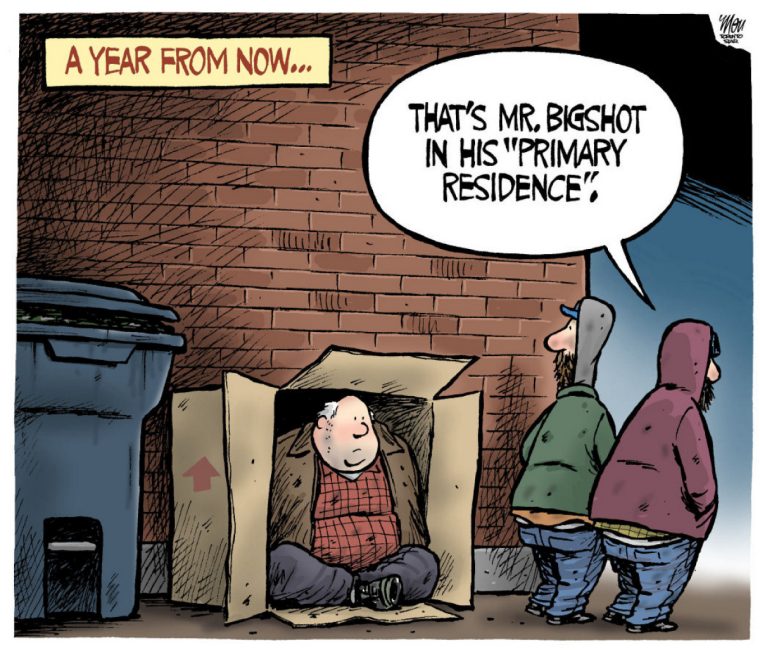

Another change that was made at the Federal level was one that affected the Principal Residence Tax Exemption (PRE). They altered the reporting requirement for the CRA (Canadian Revenue Agency) for the sale of a residence. The target of these changes to the PRE is aimed at primarily at investors who may be skirting the law. Specifically, at investors who are holding multiple properties on speculation – who may be positioning these properties as Principal Residences (owned by different family members) – putting strain on already tight supply and pushing prices up.

However, these changes to the PRE may potentially impact all homeowners, who up to this point may have been able to avoid reporting their sale(s) and paying taxes.

Here is a breakdown of what you need to know.

The Principal Residence Exemption (PRE)

As part of your taxable income, you typically need to pay money on the return on your investments when they increase in value, including real estate. In the case of property investment, when you sell a property, you realize capital gains (profits after expense). There are exemptions for paying capital gains tax, which are advantageous to the investor because it improves the overall return on the investment. In the case of real estate, if the home that you sell is your principal residence, you are exempt from paying that capital gains tax. There are a few stipulations, among them that you must have designated the home as your principal residence during the entire tenure of your ownership.

Prior to these changes from the Government, many homeowners have assumed that the sale of their home was always tax exempt under the PRE. Anecdotally, there were even situations in which people should have paid tax on the sales of their homes, but it seems that this grey area has been largely unregulated and unmonitored by CRA. With the introduction of this new rule, that is changing.

Consider this scenario laid out in this Globe and Mail story, “How Principal-Residence Tax Changes Will Affect Every Canadian Homeowner”, in which a homeowner owns a “city” home (i.e. their principal residence) and a cottage. He sells both at a profit, but doesn’t declare tax on either, nor does he officially designate either property as his principal residence. In theory, he should have paid tax on the sale of the cottage, and designated his city home as his residence officially, but the reporting structure around residence and application of taxes have been largely unregulated to date. That has changed.

The Changes

There are no changes to the Principal Tax Exemption itself; when you sell your principal residence, you don’t pay tax on any increase in value that you realize.

But – all homeowners are now required to report basic information around their home purchase and sale – like when you bought it, proceeds of disposition and a description of the property on your tax return. If you don’t disclose the sale, then you may not be eligible for the tax exemption for your principal residence in future years. You also need to designate your home as your principal residence. If you forget (or forgo this step, as was common under the old reporting) to designate a property as a principal residence (as the fellow did in the above Globe and Mail story scenario) you could be penalized. If you are late reporting the disposition of the principal residence then you could be on the hook for $800/month late filing penalty up to a maximum of $8000.

One other major change is that the CRA has extended the period of assessment. They’ve removed the three-year audit limit, which essentially extends in indefinitely at this point. This is to encourage compliance.

Notes On Residence Designation

A residence doesn’t necessarily have to be lived in all year in order for it to count as the principal residence. If you or your spouse or your children have lived in the home for part of the year, it can still count as a principal residence. Property type doesn’t matter -condo, trailer, detached home, cottage or houseboat – they are all the same. You are allowed one principal residence per family.

You do have some choices if you own multiple properties, in that you can designate one home as your primary residence during your tenure of ownership and then switch it.

If you change the nature of the residence (i.e. switch it to a rental property or to a commercial use or vice versa) you need to disclose that information as well. You are not allowed to generate income from your portion principal residence.

The Impact?

The thought is that this will remove the likelihood of foreign investors holding multiple empty properties on speculation, as is suspected to be occurring in Vancouver and Toronto. The way that this tax is applied and how qualifications for exemption are structured, it should have an impact on property renovators as well. Renovators who consecutively buy and sell will now have to justify the “residence” part of their homes, when they are bought, renovated and purchased in quick succession. Essentially in some of these situations homes serve as inventory for real estate trade, and not exclusively as a personal residence, rendering them taxable. The objective is that instead of flippers constantly moving, fixing up and reselling under the Principal Residence exemption, they should be taxed as a business or investment.

With all tax information, you are always best to consult a professional, especially to help you make sure that you’ve done the paperwork properly and also to advise you on tax strategies, especially if you are a property investor.

Here are some great links that help to summarize the PRE changes and the implications for homeowners: “How Capital Gains Strategies Change Under The New Tax Rules”, “8 Questions About The Principal Residence Tax Rules” and “Filing: Principal Residence”.

At Urbaneer, we fully support our clients throughout every transaction and help them to make intelligent real estate moves that complement their investment holdings and investment strategy. We are here to help!

~ Steven and the Urbaneer Team

Steven Fudge, Sales Representative

& The Innovative Urbaneer Team

Bosley Real Estate Ltd., Brokerage – (416) 322-8000

Celebrating Twenty-Five Years As A Top-Producing Toronto Realtor

*Like what you’ve read? Consider signing up in the box below to receive our FREE monthly newsletter on housing, culture and design, including our love for unique urban homes and other Toronto real estate.

*Have you seen Steven’s newest site Houseporn.ca? It’s his Student Mentorship site on Canadian architecture, landscape, design, products and real estate!

Real Estate